| Quick View | Details |

|---|---|

| Main Idea | Take profit and pay yourself first, then run the business on what is left |

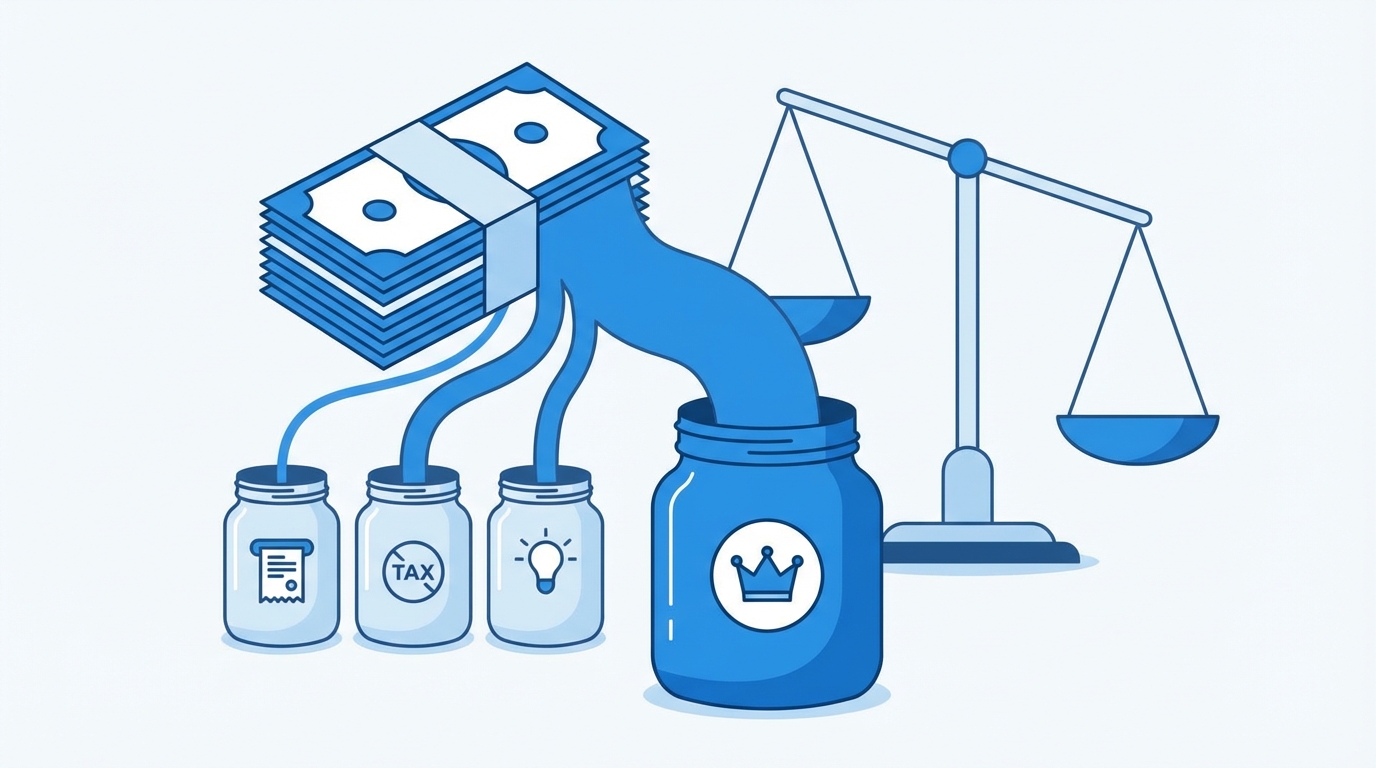

| Core Mechanism | Separate bank accounts for Profit, Owner Pay, Tax, and Operating Expenses |

| Best For | Small and mid-sized businesses, solos, agencies, coaches, service providers, ecom |

| Biggest Benefit | Profit becomes a habit, not a wish at year end |

| Main Drawback | Requires discipline and changes how you see cash and “growth” |

| Time To Implement | 2 to 3 hours to set up, then 15 to 30 minutes twice per month |

You probably did not start your business so that you could stress over payroll every second week. Yet that is where most owners live. Revenue grows, clients come in, and somehow there is still no real profit. The Profit First methodology flips that script. It forces you to treat profit like rent: non‑negotiable, paid first, and baked into how you run things, not a bonus if something is left over. The reason this matters is simple: if you do not control your cash, your business controls you. Profit First gives you a simple, mechanical way to take control. Not perfectly. Not with a magic formula. Just with practice and clear rules you can follow even on a bad day.

What Profit First Actually Is (Without The Hype)

Profit First is a cash management system popularized by Mike Michalowicz. The idea is simple enough that it almost sounds too simple.

You allocate every dollar of income into separate buckets the moment it hits your main account. Those buckets are actual bank accounts, not a spreadsheet that you ignore.

Here is the twist: you do not start with expenses. You start with:

1. Profit

2. Owner pay

3. Taxes

Whatever is left goes to operating expenses.

Profit First is not about “making” more profit. It is about forcing your business to live on what it can actually afford.

Technically, this is not a full accounting system. Your bookkeeper will still use traditional profit and loss statements. Profit First sits on top of that as a behavior system.

You are not trying to be clever with money. You are trying to be consistent.

Why Most Businesses Stay Busy But Broke

Before you tweak anything, you want to see the pattern you are fighting.

Most owners follow a simple mental formula:

Sales – Expenses = Profit

So you chase sales. Then you pay expenses. Then, if there is something left, you take some out. It feels logical. It is also why the cycle of “next month will be better” never ends.

What actually happens:

– You see a higher bank balance.

– You feel safer.

– You say yes to more tools, staff, ads, software, training.

– The bank balance drops.

– You sell harder to bring it back up.

It feels like growth. It is often just getting more complex, with the same or lower true profit.

The Parkinson’s Law Trap

Parkinson’s Law says that work expands to fill the time you give it. Money works the same way.

If you keep all your cash in one big account, your expenses expand to match that number. You tell yourself “we can afford this” because there is money there.

Profit First uses Parkinson’s Law against itself:

– Limit what is visible for expenses.

– Your brain adjusts behavior to that smaller amount.

– You still get things done, just with fewer leaks.

It is not magic. It is psychology.

The Core Structure: The 5 Main Accounts

Profit First rests on a simple structure of bank accounts. You can add more later, but you start with five:

1. Income

2. Profit

3. Owner’s Pay

4. Tax

5. Operating Expenses (OPEX)

Let us walk through each.

1. Income Account

Think of this like a staging area.

All revenue lands here first. You do not pay any bills from this account. You do not swipe a card from this account. The only job of the income account is to receive money and then feed the other accounts.

On set days, you clear this down to zero by distributing funds to the other accounts based on pre-set percentages.

2. Profit Account

This is your business’s reward account.

You move a fixed percentage of all income into Profit, every allocation day. You do not touch it for day-to-day expenses.

Each quarter, you take half of the Profit account as a distribution to yourself. The other half stays in the account as a long-term buffer.

Profit is not selfish. Profit is how you keep your business alive long enough to help more people.

The quarterly payout matters. It creates a tangible reward. Your brain starts to link “sticking to the system” with “I get paid extra.”

3. Owner’s Pay Account

This one is for you as an employee of your own business.

Too many owners pay everyone else first and themselves last. That is how resentment builds. It is also how you end up personally broke while the business “looks” big from the outside.

Owner’s Pay gets a set percentage from each income allocation. That account then pays your personal salary on a fixed schedule.

Think of Profit as your reward for owning the business. Think of Owner’s Pay as your paycheck for working in it.

They are not the same thing.

4. Tax Account

Taxes are not a surprise. You know they are coming. Yet many owners act like the tax bill is some shock every year.

A fixed percentage of income goes straight into the Tax account. You do not borrow from it for expenses. You do not see it as “extra cash.”

When tax time comes, you have the money already set aside.

Technically, your actual tax rate depends on structure, country, and profit, but you start with a conservative number and adjust with your accountant data over time.

5. Operating Expenses (OPEX) Account

What is left after Profit, Owner’s Pay, and Tax goes here.

This is the account you use to run the business:

– Tools

– Software

– Payroll (for team, not you as owner)

– Marketing spend

– Rent

– Contractors

You do not pull from Profit or Tax to cover overruns. If OPEX is short, you cut or delay expenses, or you focus on better margin sales. That is the discipline.

Your expenses must fit your business, not the other way around.

Target Allocation Percentages: What The Numbers Look Like

Profit First uses Target Allocation Percentages (TAPs). These are the long-term percentages you aim for.

Here is a sample set for a healthy small business with revenue up to around 250k to 500k per year. This is only a rough starting point, not a promise.

– Profit: 5 to 10 percent

– Owner’s Pay: 30 to 50 percent

– Tax: 10 to 15 percent

– OPEX: 30 to 55 percent

If you are doing 100k in revenue and your take-home pay is 25k, your Owner’s Pay percentage is 25 percent. If you run at 10 percent profit on paper but you never see it in the bank, your real profit is closer to 0.

Profit First forces these numbers into your bank structure.

Reality Check: Your Current Allocation

Before you set new percentages, you measure where you are now. You can do this in a simple spreadsheet.

Take the last 3 to 6 months and total:

– Total revenue collected

– Total owner’s pay you actually took

– Total taxes you paid or set aside

– Real profit distributions you took (not just “profit on paper”)

– Total operating expenses

Then convert each into a percentage of revenue.

Many owners find something like this:

– Profit: 0 to 2 percent

– Owner’s Pay: 5 to 20 percent

– Tax: 0 to 5 percent

– OPEX: 70 to 95 percent

That picture can sting. It is also the point where change becomes practical.

How To Set Up Profit First In Your Business

This is where you move from idea to practice. Think of it as a series of small steps, not a weekend overhaul.

Step 1: Open The Separate Accounts

You contact your bank and open:

– 1 Income account

– 1 Profit account

– 1 Owner’s Pay account

– 1 Tax account

– 1 OPEX account

You might also open “parking” accounts at a secondary bank for Profit and Tax, so you are less tempted to dip into them.

Ask for basic no-frills checking or savings options. Fancy is not required. Clear separation is.

Step 2: Decide Your Starting Percentages

Jumping straight to ideal percentages is risky. If you cut OPEX from 80 percent to 40 percent overnight, your operations might break.

Instead, you move in small steps.

Example: say your current reality looks like this:

– Profit: 1 percent

– Owner’s Pay: 15 percent

– Tax: 4 percent

– OPEX: 80 percent

You want to reach this in 12 to 18 months:

– Profit: 10 percent

– Owner’s Pay: 40 percent

– Tax: 15 percent

– OPEX: 35 percent

Your first step might be:

– Profit: 2 percent

– Owner’s Pay: 17 percent

– Tax: 5 percent

– OPEX: 76 percent

Small shifts. But real ones.

Every quarter, you raise Profit, Owner’s Pay, and Tax a bit, and you lower OPEX to balance.

Step 3: Set Your Allocation Rhythm

Profit First uses fixed “allocation days” where you move money from Income into the other accounts. Most owners pick:

– Twice a month: on the 10th and 25th

or

– Every week: same day each week

On each allocation day:

1. Look at the balance in the Income account.

2. Record that number.

3. Apply your current percentages.

4. Transfer funds to Profit, Owner’s Pay, Tax, and OPEX.

5. Leave Income at or near zero.

This rhythm matters more than the exact percentages at first. Your brain starts seeing cash as “already spoken for.”

Step 4: Protect Profit and Tax

This is where many owners cheat.

You see a big software deal. Or a new team member. Or a campaign you want to try. OPEX is low. Profit has money. The temptation appears: “I will just borrow from Profit this one time.”

That one time becomes your pattern.

A simple rule that helps:

Treat Profit and Tax like rent money: not available for experiments, ever.

If you really must adjust, change your official percentages at the next quarter after you review everything. Do not just raid the account impulsively.

How Profit First Changes Day-To-Day Decisions

The real power of Profit First is not in the accounts. It is in how it changes your choices without you needing willpower every time.

Spending Becomes A Question, Not A Reflex

When you look at your OPEX account and see the balance, that is the hard limit.

You want to buy a new course, tool, or ad campaign. Instead of “Do I want this?” the question becomes “Does OPEX have the room for this right now?”

If yes, fine. If not, you delay, cut something, or go earn more high-margin revenue first.

Your spending shifts from emotion to constraint.

Pricing And Margin Get Real

Profit First exposes low-margin offers.

If your OPEX account never has enough, even after cutting waste, you have one of two problems:

– Prices too low relative to cost

– Offer mix too heavy in low-margin work

You might realize that one service line looks busy but eats all your OPEX. Another line, maybe a recurring retainer or a productized service, brings in more profit for less complexity.

Technically, you always “knew” this. The accounts force you to act on it.

Growth Stops Being “More At Any Cost”

Revenue by itself loses some of its shine.

You start asking:

– “What revenue type feeds Profit and Owner’s Pay best?”

– “What clients are expensive to serve?”

– “What work burns my team out for little return?”

That clarity leads to sharper focus, even if it feels a bit restrictive at first.

Common Objections And Honest Answers

Not every objection is wrong. Some signal where you need to tailor the system.

“I Cannot Afford Profit Right Now”

This is the most common pushback.

If your business runs so tight that 1 percent profit breaks it, you already have a structural problem. Profit First does not create the problem. It reveals it.

Start tiny:

– Day 1: set Profit to 1 percent of all income.

– Treat that as non-negotiable for 90 days.

– Watch what changes.

You will cut something. You will delay something. Or you will push for slightly better deals or slightly better clients. That movement is the point.

“My Business Is Different”

Every industry says this. Agencies say it. SaaS founders say it. Lawyers say it. Ecom founders say it.

Cash still moves the same way.

Profit First does not care if your revenue is lumpy, seasonal, or subscription. You can adjust percentages and rhythms, but the core idea holds:

Profit, pay, and tax come first. Expenses adapt to reality.

“My Accountant Already Has A System”

Your accountant looks backward. They tell you what happened.

Profit First focuses on what you do next with cash as it comes in. It is not a replacement for bookkeeping. It is a front-end behavior system.

A good accountant can help you tune your percentages over time. They do not need to like the method at first. Their job is accuracy; your job is health.

Practical Example: Applying Profit First To A Small Service Business

Let us walk through a simple scenario.

You run a marketing agency doing around 30k per month in collected revenue.

Right now:

– You pay yourself a variable amount depending on how the month went.

– Taxes catch you off guard.

– You end most months with almost no cash cushion.

You decide to try Profit First with conservative starting percentages:

– Profit: 3 percent

– Owner’s Pay: 30 percent

– Tax: 12 percent

– OPEX: 55 percent

Month 1: Basic Allocation

Allocation rhythm: 10th and 25th.

On the 10th, your Income account holds 18,000.

You allocate:

– Profit: 3 percent of 18,000 = 540

– Owner’s Pay: 30 percent = 5,400

– Tax: 12 percent = 2,160

– OPEX: 55 percent = 9,900

You transfer:

– 540 to Profit

– 5,400 to Owner’s Pay

– 2,160 to Tax

– 9,900 to OPEX

Income account returns to near zero.

On the 25th, another 12,000 arrived.

You allocate again:

– Profit: 360

– Owner’s Pay: 3,600

– Tax: 1,440

– OPEX: 6,600

By the end of the month, totals look like this:

– Profit: 900

– Owner’s Pay: 9,000

– Tax: 3,600

– OPEX: 16,500

You pay yourself a fixed salary from Owner’s Pay (say 7,000) and leave the extra 2,000 there as a cushion for leaner months.

Your tax account now holds 3,600. Profit holds 900.

End of Quarter: Profit Distribution

After three months, your Profit account might hold, say, 3,000.

You take half (1,500) as a bonus distribution.

You leave 1,500 as a longer cushion.

Does 1,500 change your life? No. What changes your life is the pattern. For the first time, profit is a planned event, not random luck.

Using Profit First In Your Personal Finances

You can apply similar thinking to your life.

Personal version might look like:

– Income account (where your salary lands)

– Bills account (rent, utilities, regular payments)

– Freedom / Investing account

– Short-term savings account

– Fun / discretionary account

When paycheck hits:

– Move fixed percentages into each.

– Treat Freedom / Investing like Profit: non-negotiable.

– Treat Bills like OPEX: make your life fit the number.

Again, small percentages matter:

– 2 to 5 percent to start for investing

– Gradually rising over the year

Life starts to feel less reactive. Funds for the future stop being “what is left.”

Profit First For Different Business Models

The structure stays the same, but you tweak percentages and sometimes add sub-accounts.

Agencies And Service Firms

Project-based and retainer work can be lumpy.

Challenges:

– Large upfront payments

– Heavy contractor costs

– Scope creep that hurts margin

You might add:

– “Subcontractor” account separate from OPEX, funded from a piece of each payment dedicated to delivery costs

Allocations might look like:

– Profit: 5 to 8 percent

– Owner’s Pay: 35 to 45 percent

– Tax: 15 percent

– Contractors: 10 to 25 percent (depending on model)

– OPEX: rest

This helps you see when a project price is too low to cover both contractors and OPEX.

Coaches, Consultants, And Creators

These models can have high margin if you avoid over-staffing and bloated software stacks.

You may be able to push:

– Profit: 10 to 15 percent

– Owner’s Pay: 40 to 50 percent

– Tax: 15 percent

– OPEX: 20 to 30 percent

You also may want a separate small “Professional Development” account for training and events, so those costs are planned, not impulsive.

Ecommerce And Product Businesses

Ecom has a heavy cost of goods sold, fulfillment, and ads.

You might separate:

– COGS account (inventory, shipping supplies)

– Marketing account (ads, influencers, creative)

Allocation example:

– Profit: 5 percent

– Owner’s Pay: 20 to 30 percent

– Tax: 10 to 15 percent

– COGS: 25 to 40 percent

– Marketing: 10 to 25 percent

– OPEX: 10 to 20 percent

Your numbers will depend on your niche and price points, but having COGS and Marketing as separate buckets helps keep you honest.

Traps And Mistakes To Watch For

This system is simple, but you are still human. There are traps.

Trap 1: Over-Correcting Too Fast

You read a case study and try to jump from 2 percent profit to 15 percent overnight. OPEX starves. Teams panic. You get frustrated and abandon the system.

Cleaner path:

– Adjust 1 to 2 percentage points per quarter.

– Only faster if you have clear surplus and stable delivery.

Profit First is more like building a muscle than flipping a switch.

Trap 2: Treating Profit As A Savings Account To Raid

You keep dipping into Profit when things feel tight.

The fix is mechanical:

– Move Profit (and sometimes Tax) to a different bank.

– Make the transfer back slow enough that you will not do it casually.

If it takes 2 or 3 days to pull from that account, you are more likely to seek better solutions first.

Trap 3: Ignoring The Story The Numbers Tell

You can run the transfers and still avoid thinking.

Profit First shines a light on problems:

– If OPEX is always short, something is off in pricing, scope, or structure.

– If Owner’s Pay is tiny, you built a job for everyone but yourself.

– If Profit is low, you take risk without much reward.

The accounts are not the goal. Your behavior and decisions are.

Profit First And Personal Wellbeing

This system is about cash, but it affects more than money.

Less Mental Load

You no longer look at one big account and guess.

You see:

– How much is safe to spend

– How much is reserved for taxes

– How much you can pay yourself

– How much the business is truly keeping as profit

That clarity can reduce a lot of background stress. The late-night mental math starts to fade.

Healthier Relationship With Growth

Growth stops being “more revenue at any price.” You start to prefer:

– Fewer, better clients

– Products with cleaner margin

– Growth that does not burn you out

That shift can change how you structure your weeks, who you hire, and even who you choose to work with.

How To Get Started This Week

If you want to begin without overthinking, here is a simple seven-day plan.

Day 1-2: Measure Reality

– Pull 3 to 6 months of bank statements.

– Calculate how much came in.

– Calculate what you took home personally.

– Estimate your true tax payments.

– See what went to expenses.

Turn those numbers into percentages. Do not judge them. Just see them.

Day 3-4: Open The Accounts

– Call or visit your bank.

– Open the extra accounts.

– Label them clearly in your online banking.

If the bank pushes back or seems confused, keep it simple: “I want separate accounts for budgeting.”

Day 5: Pick Tiny Starting Percentages

Choose something you know you can stick with for 90 days, even if the business wobbles:

– Profit: 1 percent

– Owner’s Pay: 1 to 5 percentage points higher than you pay yourself now

– Tax: a realistic first step, maybe 5 to 10 percent

– OPEX: whatever is left

Write these down. Share with your bookkeeper, if you have one.

Day 6: Do Your First Allocation

Pick the current Income balance and run the math.

Transfer the funds. Close your laptop. Walk away.

Your business did not break. But something shifted.

Day 7: Decide Your Allocation Rhythm

Set calendar reminders:

– Twice per month or weekly

– Time blocked for 15 to 30 minutes

– Same process each time

Consistency beats intensity here. Medium effort, repeated, will do more for your profit and your life than one heroic budgeting weekend you never repeat.

Profit First turns “I hope there is money left” into “Profit is part of how we operate around here.”

You see your business differently when profit, your pay, and taxes are guaranteed before expenses. The numbers may start small. The habit is where the real growth lives.