Invoicing Mistakes That Delay Payment

Common Invoicing Mistake Business Impact Simple Fix Missing or vague payment terms Clients “forget” deadlines, pay late Put clear due date, method, and late fees on every invoice Wrong or unclear contact details Invoice stuck in the wrong inbox or system Confirm billing contact and process before first invoice Math errors and typos Client disputes,

Bootstrapping vs. VC Funding: The Honest Truth

Bootstrapping VC Funding Control Full control, no outside board pressure Shared control, investor oversight Speed Slower growth, careful bets Faster growth, aggressive bets Risk Lower financial risk, higher personal stress Higher financial risk, shared personal stress Ownership You keep the equity You trade equity for cash and support Lifestyle More freedom on pace and direction

Corporate Crypto Treasuries: Should You Hold Bitcoin? (Link to General/Crypto)

Question Short Answer Should a company hold Bitcoin in its treasury? Maybe, but only after strict risk, liquidity, and governance checks. Primary benefit Asymmetric upside as a long-term store of value and strategic asset. Primary risk High volatility, regulatory uncertainty, and potential capital loss. Best fit companies Profitable, cash-rich, with long runway and high risk

Cash Flow Forecasting: Surviving the ‘Net-60’ Payment Terms

Question Quick Answer What is cash flow forecasting? Planning when cash comes in and goes out so you do not run out before clients pay. Biggest risk with Net-60 terms? You can be “profitable” on paper but broke in your bank account. Core habit to survive? Weekly cash forecast for at least 13 weeks ahead.

Managing Debt: Good Leverage vs. Bad Leverage

Good Leverage Bad Leverage Main goal Grow income or asset value Fund lifestyle or cover gaps Cash flow impact Pays for itself or more Drains monthly cash Risk level Measured, backed by real plan High, tied to hope and guessing Typical examples Profitable business, smart mortgage Credit cards, lifestyle loans Key test Will this create

EBITDA Explained: Why Buyers Look at This Number First

Item What it Means Why Buyers Care EBITDA Earnings before interest, tax, depreciation, amortization Quick view of cash earning power from operations EBITDA Margin EBITDA as % of revenue Shows quality of profits and pricing power Adjusted EBITDA EBITDA with “one‑off” items removed Gives a cleaner view of sustainable earnings EBITDA Multiple Price paid divided

The Cost of Hiring: Salary vs. Total Burden

Item Typical Range Quick Note Base Salary 100% The number you usually negotiate Payroll Taxes & Statutory Costs 10% – 18% of salary Social security, Medicare, unemployment, etc. Benefits (health, retirement, leave) 10% – 30% of salary Varies by country, industry, and generosity Overhead (office, tools, admin) 5% – 25% of salary Space, software, equipment,

Valuation Multiples: What Is Your Business Actually Worth?

Method Typical Multiple Range Best For Biggest Risk Revenue Multiple 1x – 4x+ annual revenue High growth, simple models Ignores profit quality EBITDA Multiple 3x – 8x EBITDA Stable, profitable businesses Easy to “massage” EBITDA SDE Multiple 2x – 4x seller’s discretionary earnings Owner-operated small businesses Heavily dependent on owner role Net Profit Multiple 3x

Insurance Audits: Are You Overpaying for Liability Coverage?

Question Quick Answer Are most businesses overpaying for liability coverage? Many are, often 10% to 30% above what they should pay. Biggest reason for overpaying Wrong payroll / revenue estimates and old classifications that never get cleaned up. What fixes it Annual insurance audits, clean data, and active communication with your broker. Time required each

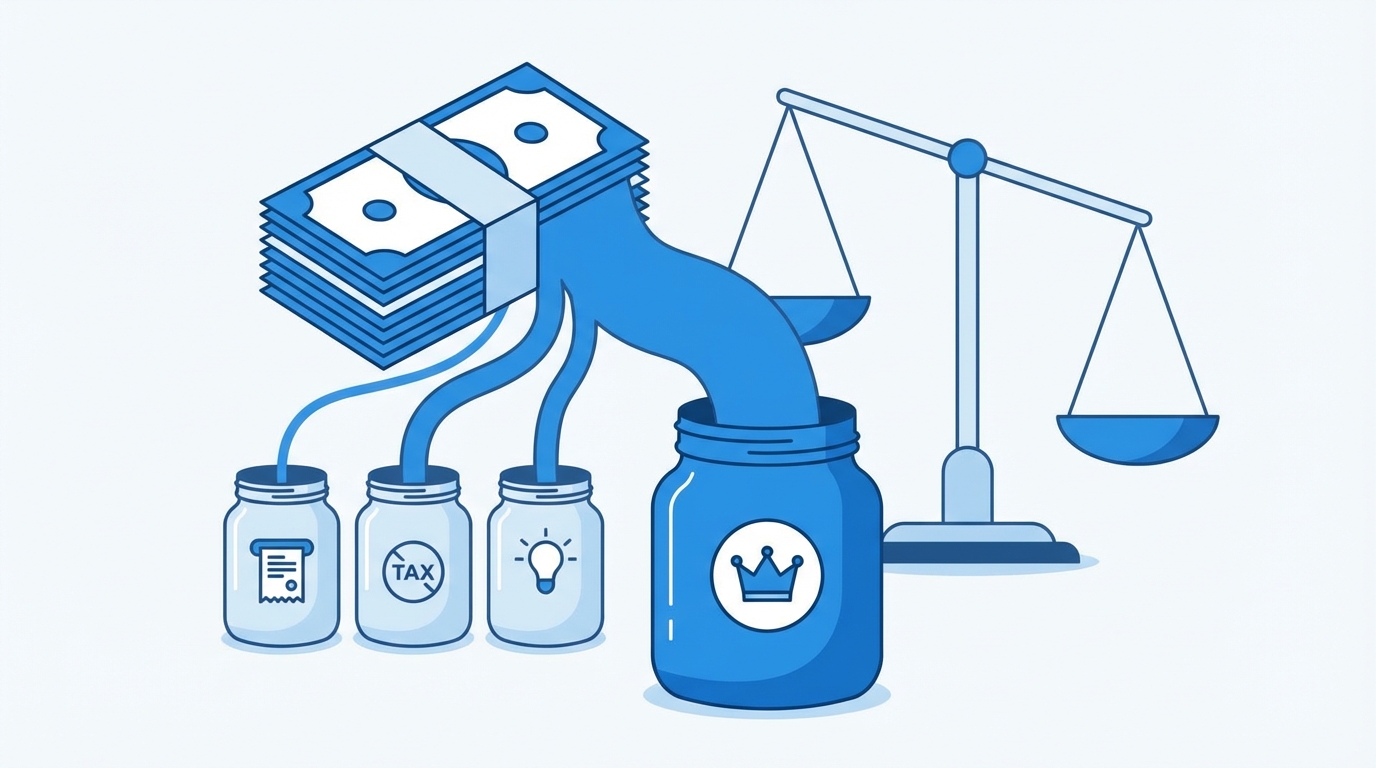

Profit First Methodology: Allocating Cash Before Expenses

Quick View Details Main Idea Take profit and pay yourself first, then run the business on what is left Core Mechanism Separate bank accounts for Profit, Owner Pay, Tax, and Operating Expenses Best For Small and mid-sized businesses, solos, agencies, coaches, service providers, ecom Biggest Benefit Profit becomes a habit, not a wish at year