| Tool / Method | What it Shows | Best For | Main Drawback |

|---|---|---|---|

| Meta Ad Library | Live Facebook & Instagram ads | Creative angles, hooks, compliance checks | No spend or conversion data |

| Google Ads Transparency Center | Search, YouTube, Display ads | Keywords, messaging, landing page ideas | Limited historical view |

| Similarweb / SEMrush / Ahrefs | Traffic sources, top pages, paid vs organic mix | Channel strategy, budget focus | Estimates, not exact numbers |

| AdSpy / BigSpy / PowerAdSpy | Large ad creative libraries across platforms | DTC, info products, creative testing ideas | Quality can be hit or miss for some niches |

| BuiltWith / Wappalyzer | Tech stack, tracking tools, AB testing tools | Tech choices, funnel sophistication | No direct performance insights |

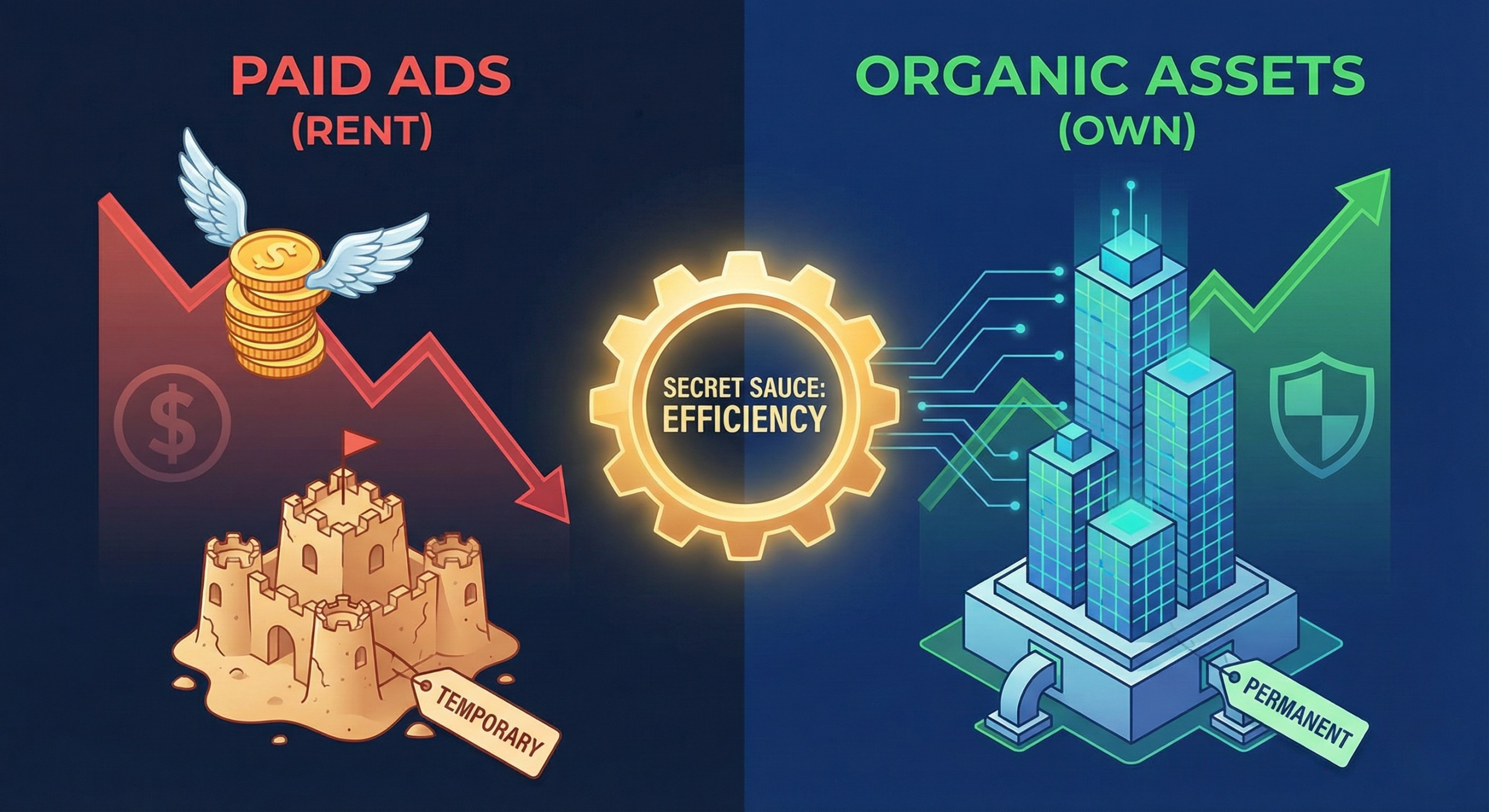

Most marketers guess what works in ads. The better ones spy first, then build. Competitor analysis gives you a shortcut: you see where others spend real money, what messages survive, and which platforms actually move customers. You still need your own offers and brand, but you no longer fly blind. You can connect the tech, copy, and strategy in a clear way instead of hoping the algorithm likes you.

Why spying on ad strategies is not cheating

Let me clear this up. Every serious marketer studies competitors. The question is not “if” but “how smart” you do it.

Think about your market like a poker table. Your competitors are already showing some of their cards. You can see:

– Where they advertise

– How long they keep ads running

– What they push hardest

– Which funnels they protect or promote

You would be crazy to ignore that.

The goal is not to copy ads. The goal is to copy learning speed.

When you spy well, you:

– Skip weak angles that already failed for others

– Spot working hooks faster

– Understand platform risk before you spend

– See where tech helps or hurts your funnel

There is a direct link to business and life growth here. You cut time from “trial and error” and move into “trial with context”. That gap is massive over a year or two.

Types of competitor analysis for ad strategies

You usually want answers to five questions:

1. Where are they buying traffic?

You want to know if they live on:

– Meta (Facebook/Instagram)

– Google (Search, Display, YouTube)

– TikTok

– LinkedIn

– Native (Taboola, Outbrain, etc.)

– Email sponsorships

– Affiliates

You do not need exact spend. Direction is enough. If every top competitor in your niche is heavy on YouTube, ignoring YouTube is a choice, not an accident.

2. What angles and hooks are they betting on?

Hooks are the short phrases that grab attention:

– “Stop wasting money on X”

– “The 10-minute way to do Y”

– “What nobody tells you about Z”

Ads are hook testing platforms. When you spy, you see hooks worth testing in your own voice.

3. What offers are they pushing the hardest?

Look for:

– Free vs paid offers

– Trials vs demos vs “buy now”

– Bundles vs single products

– Low-ticket tripwires vs straight to high ticket

Your competitors’ offers show you how the market likes to buy.

4. Where do the ads send traffic?

This is where tech comes in. You want to view:

– Landing page structure

– Popups, banners, exit-intent

– Chat widgets

– Forms and conversion flow

– Payment providers

– Tracking scripts

The combination of ad + landing page + tracking is the actual system. You are not just copying lines. You are learning how they connect tools.

5. How serious are they about testing?

Look for:

– Many variants of the same idea

– Subtle changes in headline, thumbnail, CTA

– Ongoing refresh of creatives

Teams that test hard tend to grow faster. That tells you who to watch more closely and who is just dabbling.

Free tools to spy on competitors’ ads

You can learn a lot without paying a cent.

Meta Ad Library for Facebook and Instagram

If you run paid social and you ignore Meta Ad Library, you are missing free money.

How to use it:

1. Search by brand name

2. Filter by country and platform

3. Sort by “Active” ads

4. Scan for ads that have been running for a long time

Why the “long time” part matters: brands keep ads running only if they at least do not lose money. Short-lived ads can be tests or failures.

Look at:

– Hooks in the first 2 seconds of video

– First lines of primary text

– Offer structure: discounts, bonuses, trials

– CTAs used most often

– Comments to see real objections

An ad that runs for 3+ months is a case study your competitor paid for.

Limitations:

– You cannot see budget or ROAS

– You cannot see audience targeting

– Performance is hidden

Still, for creative and offer ideas, this is gold.

Google Ads Transparency Center

Search and YouTube are intent machines. When someone types “best CRM for coaches”, that is buying intent. Seeing what ads show up there teaches you a lot.

Use the Transparency Center to:

– Search by advertiser name or website

– Filter by country and format (search, video, display)

– Inspect ad copy and landing pages

Pay attention to:

– Which benefits they mention

– Which objections they handle in the ad

– How aligned the landing page is with the ad message

– Whether they separate search pages from YouTube pages

You can also run real Google searches in incognito and screenshot:

– Paid ads at the top

– Organic results

– Ad extensions

– Sitelinks

Use this later to map how aggressive your competitors are on intent keywords.

TikTok Creative Center

If your niche skews younger or visual, TikTok ads are worth studying.

The Creative Center gives you:

– Top ads in various categories

– Engagement metrics (views, likes, etc.)

– Hook lines

– Length of the best ads

Patterns you want to notice:

– Common visual styles (UGC, studio, screen share)

– Sound use

– On-screen text and captions

– Where CTAs appear in the video

TikTok style is different from Meta and YouTube. It feels less polished, more “I shot this at home”. Seeing how your competitors handle that style helps you not feel awkward when you try your own.

Native ad spy through the open web

Native ads on sites like news portals can feel hard to study, but you can get clues.

Simple methods:

– Visit big news sites and scroll until you see “Sponsored content”

– Click competitor-looking ads and note:

– Headlines used

– Thumbnails

– Pre-sell page structure

It is manual, but for some niches (health, finance, hobbies), native is big. You want to know if your competitors play there.

Paid spy tools that actually help

Free tools are great to start, but at some point you want speed. That is where paid spy tools come in.

AdSpy, BigSpy, PowerAdSpy and similar

These tools collect enormous numbers of ad creatives across platforms.

You use them to:

– Search by keyword in ad copy

– Filter by platform, country, date, CTA

– Sort by engagement metrics

For example, if you sell a project management tool, you might search:

– “manage projects”

– “client portal”

– “freelance work management”

Then look at:

– Video vs image ratio

– Whether top ads show the interface or just outcomes

– What offers are tied to signups

AdSpy-type tools are especially useful for:

– DTC products (beauty, fitness, gadgets)

– Info products (courses, coaching)

– SaaS with clear visuals

Problems to expect:

– Some verticals are underrepresented

– Metrics like “likes” do not always equal sales

– You can drown in data

So use them with a simple rule: filter hard, then pick 10 to 20 ads per week to study in detail.

SEMrush, Ahrefs, Similarweb for traffic strategy

These tools are not pure ad spy tools. They show traffic patterns. But they are critical for linking ad strategy to tech and funnel.

Look at:

– Traffic split: direct, organic, paid, referrals, social

– Top paid keywords your competitors bid on

– Landing pages that get most paid visits

– Countries where paid traffic is strongest

If you see:

– 60% of a competitor’s traffic from paid search

– Heavy bidding on “[niche] software”, “[niche] tool”, “alternative to [brand]”

you know they lean hard on problem-aware and solution-aware buyers.

Combine that with the spy tools that show creatives. You get a picture of:

– Their acquisition cost assumptions

– How hard they push bottom-of-funnel vs top-of-funnel

– Which geos they test first

Yes, the data is estimated. No, it is not perfect. But directionally, it is very useful.

WhatRuns, BuiltWith, Wappalyzer for tech stacks

Here is the link to tech part.

These tools reveal what is behind your competitors’ sites:

– CMS: WordPress, Webflow, custom

– Analytics: Google Analytics, GA4, Hotjar, Mixpanel

– Ad platforms: Meta Pixel, Google Ads, LinkedIn Insight Tag, TikTok Pixel

– AB testing: Optimizely, VWO, Google Optimize (or alternatives)

– Personalization tools

– Chat and support tools

When you know the tech stack, you know how seriously a competitor takes data and testing.

Example:

If you see:

– Meta Pixel

– Google Ads tag

– TikTok pixel

– Segment or similar CDP

– Advanced AB testing tool

– Server-side tracking

you are not dealing with a casual advertiser. That company probably measures everything. Their ads reflect ongoing learning, not random guesses.

You can also see:

– Exchange tools like Klaviyo, HubSpot, ActiveCampaign

– Landing page builders like Unbounce, Leadpages, Instapage

– Payment systems like Stripe, Braintree, Chargebee

This tells you how fast they can launch new offers, add upsells, and change funnels.

How to build a simple competitor ad spy system

Tools without a system lead to screenshots collecting dust. You want a light process you can run weekly.

Step 1: Pick 5 to 10 true competitors

Not every brand in your space is worth studying. Focus on:

– Direct competitors with similar pricing and audience

– Players who spend heavily on ads

– Fast growers that show up everywhere

You can tell who spends by:

– Seeing them often in your feeds

– Using Similarweb / SEMrush to check their paid share

– Watching creative volume in Meta Ad Library

Make a simple spreadsheet with:

– Brand name

– Website

– Main product or offer

– Channels used (Meta, Google, etc.)

Step 2: Set a weekly “spy session”

Block 60 to 90 minutes once a week. During that time:

– Open Meta Ad Library for each brand

– Check Google Ads Transparency Center

– Run a quick Similarweb or SEMrush check

– Run BuiltWith / Wappalyzer on new pages you discover

You are not trying to do a PhD. You just want to watch what changes.

Questions to ask:

– Which new hooks appear this week?

– Which creatives disappear?

– Are they pushing a new offer or lead magnet?

– Did their tech stack change? New tools added?

Capture:

– Screenshots of key ads

– URLs of landing pages

– Notes on offers or hooks that feel strong

Step 3: Build a “swipe” file with context

A swipe file is your personal ad library. But most people do it wrong. They only save images. You should always add context:

– What product or funnel this ad belongs to

– Where you found it (Meta, Google, TikTok)

– Why you think it works

– Which part you want to test yourself

Apps like Notion, ClickUp, Google Drive folders, or even a shared Slack channel work. The tool does not matter. Consistency does.

A good swipe file is not just screenshots. It is a thinking log.

Over time you will start to see patterns:

– Certain angles get repeated every few months

– Seasonal pushes for offers

– Shifts from discount-heavy to value-heavy messages

That helps you plan your calendar instead of reacting.

Step 4: Turn spying into test ideas

Every week, pick no more than 3 to 5 ideas from your spy session to test:

– A hook you want to adapt

– A landing page structure you want to borrow

– A funnel step you want to try (pre-sell page, quiz, etc.)

– A tech upgrade you want to look into (better AB testing, email capture layout)

For each idea ask:

– What are we trying to change? (click rate, lead rate, meeting booking, etc.)

– What simple version can we run in the next 7 days?

– How will we track it?

This is where tech matters again. Without basic tracking, your spying just leads to random changes.

Reading ad creatives like a strategist

Looking at ads is easy. Learning from them in a useful way takes more effort.

Look beyond aesthetics

Pretty images are nice but do not tell you much. Pay more attention to:

– Message: what problem do they name?

– Proof: testimonials, numbers, logos

– Call to action: what exact next step is pushed?

– Friction: how much effort is asked from the user?

For example, if multiple competitors in your niche use “Watch a 10-minute demo” instead of “Book a call”, that suggests calls are harder to sell cold. That is a clue, not a law, but it is worth noting.

Decode their customer understanding

Try to answer:

– What fears are they calming?

– What desires are they pushing?

– What false beliefs are they breaking?

If you keep seeing lines like:

– “You do not need a big team to do this”

– “No tech skills required”

– “Even if you tried X before and failed”

they are targeting people who feel overwhelmed and maybe burned by past attempts. That is your audience’s inner story.

When you see the same theme across many competitors, pay attention. The market tells you what it cares about.

Spot the “money pages” in their funnel

Often the best learning is not the first click. It is the page that makes the sale.

When you click competitor ads:

– Follow the path as far as you can

– Note each step: ad -> pre-sell page -> main sales page -> checkout -> thank you

– Look for where the energy of the copy peaks

Signs of a money page:

– Long copy with clear structure

– Heavy use of proof

– Multiple CTAs

– Scarcity or urgency elements

– Deep feature-benefit breakdown

If multiple competitors push traffic to similar page structures (for example quizzes or calculators), that format is probably tested.

Connecting competitor ads to their tech and funnels

This is where “spy tools” move from curiosity to direct growth impact.

Infer their attribution mindset

From tech stack and ad style, you can guess how they measure success.

If you see:

– Basic pixel tracking only

– No advanced analytics

– No AB testing tool

then their decisions might be based on surface metrics like click-through rate and cost per lead. They might kill good ads too early or scale poor leads.

On the flip side, if you see:

– Multiple analytics layers

– Tag managers

– Event-based tracking

– Experiments running

they likely watch deeper metrics:

– Lead quality

– Sales cycle length

– Lifetime value

You do not see their internal dashboard, but you do see the reflection of that thinking in their ads and funnels.

Study their landing page tech choices

Tech choices send signals:

– If they use a classic landing page builder, they value speed of tests.

– If they code pages into the main site, they may care more about brand consistency.

– If they use quizzes, calculators, or interactive tools, they focus on engagement and data collection.

Ask yourself:

– Are they sending traffic to blog posts or direct landers?

– Do they gate content with email or give it away?

– Do they push chat or bots as first step?

No single method is “right”, but patterns across strong players point to what your market responds to.

Track funnel changes over time

One spy session is a snapshot. Growth comes from trends.

Over a few months, watch:

– When they add new funnels (webinar, challenge, workshop)

– When they stop promoting certain products or offers

– When they change tech providers (for example from one email tool to another)

– When they move from single-step to multi-step funnels

If several leading brands move away from “book a discovery call” toward “watch training first”, they probably saw better show-up rates or more qualified calls. See if that aligns with what you experience.

Ethical lines and what not to do

Studying competitors is smart. Copying them word for word is lazy and risky.

Good behavior:

– Use tools to understand patterns and preferences

– Adapt angles to your brand and audience

– Build your own offers and promises based on your strengths

Bad behavior:

– Stealing copy, designs, or exact sequences

– Using similar names or pretending to be them

– Hijacking private assets or scraping behind logins

You can be aggressive with learning and still fair with execution.

Winning by understanding the market deeper is sustainable. Winning by cloning is temporary.

The more mature your business becomes, the more you care about brand reputation. Your long-term buyers will feel the difference.

Using competitor insight for both business and life growth

This might sound a bit high-level at first, but it connects.

Sharpening your decision muscle

When you watch good advertisers, you see:

– How they simplify offers

– How they cut messaging to what matters

– How they commit to tests instead of constant changes

You practice pattern recognition. That same skill helps you:

– Prioritize projects in your business

– Pick better habits in your life

– Filter noise in a world full of recommendations

Good competitor analysis is basically applied pattern recognition.

Training yourself to think in experiments

Spying on ad strategies trains you to think:

– Hypothesis

– Test

– Result

– Next step

That is not just for campaigns. It works for:

– Hiring and managing teams

– Planning your week

– Testing new routines or hobbies

Instead of judging yourself when something does not work, you start asking: “What did I learn from that test?” That shift matters a lot over time.

Protecting your focus

There is a risk here. When you spy too much, you start to chase. You copy, react, and lose your own direction.

Your job is to use competitor insight as:

– Guard rails (what to avoid)

– Inspiration (what to explore)

– Context (what your market sees)

Not as a script.

So have a simple rule:

– Spend much less time watching competitors than building your own assets.

If you keep it to a weekly block, it serves you instead of distracting you.

Concrete weekly routine you can start tomorrow

To make this practical, here is a simple routine you can follow.

Week 1: Setup

– List 5 to 10 key competitors.

– For each, collect:

– Meta Ad Library link

– Google Ads Transparency profile

– Similarweb / SEMrush overview

– BuiltWith snapshot of their main site and one landing page

Create your swipe file structure with sections for:

– Hooks

– Offers

– Funnels

– Tech stack notes

Every week after that

Run a 60-minute session:

– Check new or persistent ads on Meta and Google.

– Click at least 3 ads per competitor and follow funnels.

– Capture 5 to 10 assets with context and notes.

– Record any tech changes (new tools, new funnel types).

– Choose up to 3 things to test in your own campaigns or funnels.

Then, in your own ad accounts and site:

– Create basic experiments linked to those spy insights.

– Track one or two key numbers.

– Log outcomes next week.

Over months, this simple loop builds a private knowledge base on your niche that no tool alone can give you.

Tools give you access. Your routine turns access into advantage.

If you stick to that, spying on ad strategies becomes more than curiosity. It becomes a quiet engine that shapes how you grow your business and, in a real sense, how you train yourself to think about growth in the rest of your life.