| Aspect | High LTV Business | Low LTV Business |

|---|---|---|

| Customer Focus | Retention, relationships, repeat sales | Constant new customer chase |

| Cash Flow | More predictable, smoother | Spiky, stressful, fragile |

| Marketing Spend | Can profitably bid higher per customer | Limited bids, races to the bottom |

| Growth Strategy | Compounding, long-term view | Short-term wins, constant resets |

| Valuation | Seen as stronger, worth more | Seen as risky, worth less |

| Main Risk | Complacency with existing base | Acquisition costs crush margins |

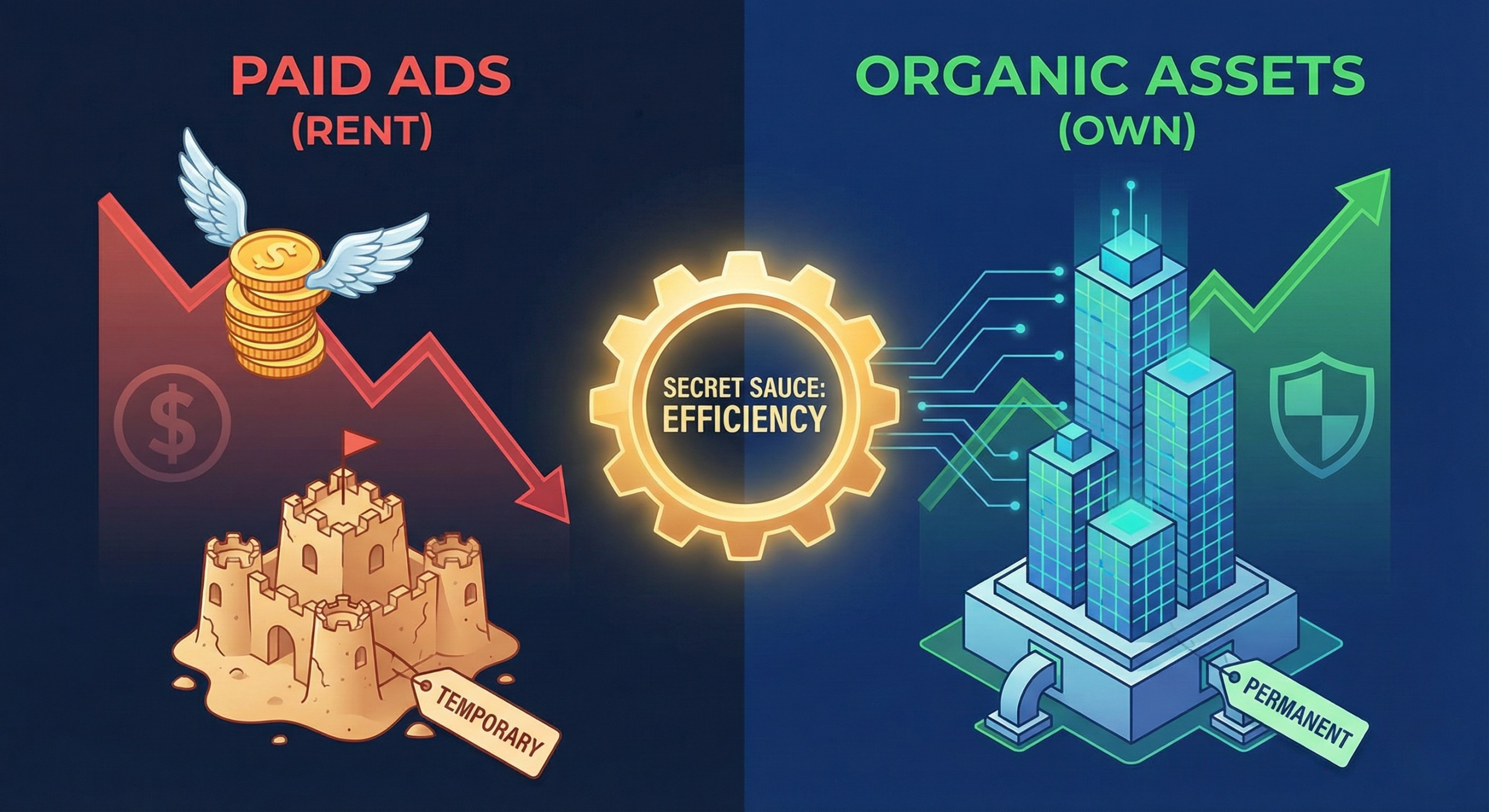

You can grow a business with many different tactics. Traffic, funnels, viral content, brand, outbound, referrals. All helpful. But if you ignore lifetime value, you end up building on sand. The numbers might look good for a while. Revenue might rise. Your ego feels pretty good. Then ad costs go up a little, competitors bid a bit more, one channel dries up, and the whole thing starts wobbling. LTV is the quiet number that decides if your business can absorb shocks, outbid competitors, and still sleep at night.

What “Customer Lifetime Value” actually means

Customer Lifetime Value, or LTV, is the total net revenue you expect to earn from a single customer over the full relationship with your business.

Not the first order.

Not this month.

The whole relationship.

If you run an ecommerce store, LTV is the sum of all orders that a customer places over time, minus returns, discounts, and the direct costs tied to those orders.

If you run a SaaS company, LTV is the revenue from all the months or years someone stays subscribed, minus the cost to keep them served.

If you are a consultant or coach, LTV could be a package, then a retainer, then referrals that client sends, even if they are not “direct” revenue lines on your dashboard.

It is not a perfect science. It is a model. But it is good enough to guide big decisions.

If you do not know how much a customer is worth over time, you are guessing how much you can afford to spend to get one.

That is usually where businesses run into trouble.

Why LTV is the only metric that really drives your growth ceiling

Revenue tells you what happened.

Profit tells you how healthy that revenue is.

LTV tells you how far you can push to get more of that profit.

If you know your LTV, you know:

– How much you can bid on ads

– How aggressive your discounts can be

– How much support and onboarding you can afford

– How patient you can be with a slow sales cycle

– How much you can reinvest back into product and service

Without LTV, you do not really have a growth strategy. You have tactics.

Why marketers obsess over LTV instead of just ROAS or CAC

Most ad accounts live and die on two numbers:

– ROAS (Return on ad spend)

– CAC (Customer acquisition cost)

CAC is what you pay to win a customer.

LTV is what you earn from that customer over time.

A lot of business owners want CAC low and ROAS high on day one. They judge campaigns only by front-end profit.

That feels safe. It also caps growth.

If your competitor knows their real LTV and you do not, they can:

– Bid higher per click

– Accept break-even or small losses on first orders

– Outspend you in every channel that matters

You look at the same ad channel and say, “This is too expensive. It does not work for us.”

They look at it and say, “We are printing cash.”

Nothing “magical” happened for them. They just did the math.

The brand with the higher LTV and the courage to spend for it wins the marketing auctions. Period.

The basic LTV formula you can actually use

You can make LTV formulas as complex as you like. Most founders never need that.

Start simple.

For subscription / SaaS businesses

A practical formula:

LTV = Average monthly revenue per user x Average customer lifespan (in months) x Gross margin

Break that down:

– ARPU: Total monthly revenue / total active customers

– Lifespan: 1 / monthly churn rate (if churn is relatively stable)

– Gross margin: (Revenue – cost of goods / service delivery) / revenue

For example:

– ARPU = 50 dollars per month

– Monthly churn = 5 percent

– So average lifespan = 1 / 0.05 = 20 months

– Gross margin = 70 percent

LTV = 50 x 20 x 0.7 = 700 dollars

That means each customer is worth roughly 700 dollars over their subscription lifetime.

If your current CAC is 150 dollars, you are in a good place.

If your CAC is 600 dollars, you might still be okay for a while, but there is very little margin for error or extra overhead.

For ecommerce businesses

Here is a simple version:

LTV = Average order value x Average number of orders per customer over a given period x Gross margin

For example:

– AOV = 60 dollars

– Average orders over 2 years per customer = 3

– Gross margin = 50 percent

LTV = 60 x 3 x 0.5 = 90 dollars

That is the real number you need when you think about your paid channels and retention strategy.

For service and consulting businesses

Here is a practical approach:

LTV = (Average project / contract value x Average number of projects per client) x Gross margin + Estimated referral value

Referral value is fuzzy, so keep it conservative.

Maybe:

– Average project = 8,000 dollars

– Average client books 2 projects

– Gross margin = 40 percent

– Referral value estimate = 3,000 dollars in net earnings across referrals

LTV = (8,000 x 2 x 0.4) + 3,000 = 9,400 dollars

Even if you are off by a bit, it gives you a clear reference point. You are not guessing anymore.

How LTV changes the way you see your business day to day

Once you accept that LTV is the main driver, your behavior changes.

Suddenly:

– You are less obsessed with cheap clicks and more focused on the right buyers

– You care more about onboarding than logo designs

– You look at service quality as a revenue driver, not a cost center

– You build offers designed to extend the customer journey, not just close a single sale

In other words, the game shifts from “How do I get more people to buy once?” to “How do I make this relationship longer and more valuable for both sides?”

LTV is not just a number in a spreadsheet. It is a reflection of how well you keep promises to your customers over time.

Why LTV and CAC must always be in the same conversation

Talking about LTV alone is half the story. CAC lives on the other side.

The relationship is simple:

If LTV < CAC, you die. If LTV is roughly equal to CAC, you survive but stay stressed. If LTV is 3 times CAC or more, you have room to breathe and grow. Most investors and buyers look closely at this ratio. Many use the "3x rule" as a quick filter. But there is context. If you are new and growing fast, a lower ratio might still be OK short term, as long as you have a clear path to better retention, more upsells, and higher pricing. If you are mature and your LTV:CAC is slowly shrinking, you are sliding into danger.

The invisible problem with “good” ROAS

You can have a “good” ROAS and a weak business.

If your campaign produces 2x ROAS on first purchase, but your LTV is not much higher than first order value, that is pretty much the ceiling.

Another brand might run 0.8x ROAS on day-one, but make back 5x over 12 months, because their LTV is strong.

From the outside, the second brand looks less “profitable” in the short term. Internally, they are stronger and can scale bigger.

How to raise LTV without annoying your customers

Once you understand LTV, your next question is simple:

How do I raise it?

Raising LTV is not just “more emails” or “more upsells.” That kills goodwill fast.

Instead, you want to think in three stages:

1. Make customers stay longer.

2. Make customers buy more often.

3. Make each purchase worth more.

1. Make customers stay longer

Retention is the biggest LTV lever.

If you are in SaaS or subscriptions, churn is the silent killer.

If you are in ecommerce, your version of churn is customers forgetting you exist.

If you are in services, churn is when clients do not come back or never expand the relationship.

Some practical retention levers:

– Onboarding that removes friction fast

Make the first 7 to 30 days incredible. Teach them how to win with your product or service. Most churn traces back to a weak start.

– Real support, not canned replies

Customers remember when your team actually helps them. That emotional memory shows up in renewals, upgrades, and referrals.

– Progress tracking

Show customers how far they have come. In apps, use in-product dashboards. In services, use simple progress reports. In ecommerce, share usage tips, milestones, or customer stories.

– Meaningful communication cadence

Regular contact that adds value, not just promos. Tutorials, behind-the-scenes context, updated best practices, even small touches that make them feel like they matter.

Retention is usually less about clever tactics and more about delivering what you promised, consistently, a little better than they expected.

2. Make customers buy more often

If customers love what you sell but only buy once a year, you have low purchase frequency.

You do not need to push them harder. You need to give them more chances to win.

Think about:

– Product line extensions

What else does your best customer need before, during, or after your main product? If you sell running shoes, think socks, insoles, training plans. If you sell email software, think strategy training, templates, deliverability reviews.

– Usage triggers

Look for natural triggers. Replenishment reminders if a product runs out roughly every 30 or 60 days. Seasonal prompts if your service fits certain times of year.

– Strategic content

Content that creates demand for the next step. Case studies that inspire, systems that reveal new gaps, tutorials that point to logical add-ons.

– Community

A small but active customer community (Slack, Facebook group, forum) keeps people engaged and aware of other ways you can help.

3. Make each purchase worth more

This is the classic “raise AOV” work, but with care.

Some levers:

– Thoughtful bundles

Put together bundles that match outcomes, not just random products. People pay more when the bundle solves the whole problem they have.

– Logical upsells

Right after the main purchase, offer a natural complement. No tricks. Just, “Most customers who buy X also get Y to solve Z.”

– Price tiers

Many brands undersell their best customers. Add a premium tier for people who want more access, faster service, or deeper help. A few high-value buyers can lift total LTV a lot.

– Raise prices when value supports it

You do not need to be the cheapest. If your product or service delivers more value than it used to, test higher pricing with new segments. Pricing has a big impact on LTV, sometimes more than any other lever.

Common LTV traps that kill growth quietly

Every metric has ways it gets misused. LTV is no exception.

Here are traps I see often.

Trap 1: Using “average LTV” and forgetting segments

If you have an email list of 50,000 customers, they are not all equal.

Some customers:

– Buy once and disappear

– Buy twice a year and never complain

– Become superfans and tell everyone they know

If you only look at an overall “average LTV,” you flatten all that.

A better approach:

– Segment by acquisition channel (paid search, paid social, organic, referrals, affiliates)

– Segment by first product bought or first plan chosen

– Segment by region, persona, or business size if you are B2B

You might learn that:

– Customers from organic search have 2x the LTV of paid.

– Customers who buy Product A first have the highest repeat rate.

– Customers from a specific geographic region churn faster.

Now you are not just “raising LTV.” You are reallocating resources toward high-LTV segments and away from low-LTV ones.

Not every customer is worth the same. Your growth depends on knowing the ones who drive your profits and treating them differently.

Trap 2: Overestimating LTV based on a tiny sample

A few early power users can trick you.

You see three dream customers who stay 2 years, refer friends, and buy everything. So you project those numbers across the whole base.

Reality comes later when the averages start falling.

Build your LTV model on:

– A big enough cohort

– A long enough period

– Conservative estimates, not best-case stories

Use rolling 6 or 12 month windows, and check if your LTV curve is flattening later than you expected.

Trap 3: Ignoring the cost to serve

Not all revenue is equal. Some customers are expensive to support.

If someone pays 3,000 dollars per year but asks for weekly custom help, that is different from someone who pays 3,000 dollars and rarely needs you.

Your LTV calculation should use gross margin, not just revenue.

And in many cases, it helps to:

– Tag support-heavy customers in your CRM

– Estimate average support hours per segment

– Include expensive perks (events, gifts, extra access) in the cost side

This lets you see “true LTV,” not just top line.

Trap 4: Chasing LTV at the expense of trust

Yes, LTV is the core metric. That does not mean you force upsells at every click.

Pushing customers into products they do not need or cannot afford lifts LTV short term and kills it long term.

Healthy LTV comes from:

– Products that actually help

– Offers that make sense

– Clear expectations that you meet

If a customer feels tricked, your short-term LTV gain turns into long-term churn, chargebacks, and brand damage.

LTV as the bridge between business and life growth

So far this has all sounded pretty “business.”

But LTV has a direct tie to your life too.

High LTV gives you more:

– Margin to hire help

Which frees your time from low-value work.

– Margin to invest in quality

Which reduces stress around customer complaints.

– Margin to weather downturns

Which protects your personal finances when markets get weird.

When your business has thin LTV, every bad month hits your life hard. You feel it in your sleep, your health, and your patience with people you care about.

When your LTV is strong and stable, you can make better long term choices.

LTV and the way you treat relationships in general

LTV is really just a financial mirror of something very basic:

Do you think short term or long term with people?

Most of the habits that grow LTV in business also improve your life outside of business:

– Keep promises longer than required

– Serve people well even when no one is “measuring” it

– Build trust through consistent behavior

– Check in before problems explode

– Look for ways to create mutual wins over time

You could call that relationship LTV.

Friends, partners, colleagues who feel that you are in it for the long run tend to show up for you when it matters. They refer you, support you, and stay loyal when things get rough.

Your business brain and your life brain are not separate. If you think of customers as disposable, that mindset leaks into other parts of your life.

How to start making LTV your central dashboard metric

If LTV is going to be the core metric, you need it visible and discussed. Not hidden in some spreadsheet only your analyst opens once a quarter.

Here is a practical rollout path.

Step 1: Define your LTV model and timeframe

Choose:

– A core formula that fits your model (subscription, ecommerce, services)

– A main timeframe (12 months, 24 months, 36 months)

You can have long-term LTV projections, but pick one primary lens for decisions. Many businesses use 12 months because it is concrete and easier to validate.

Step 2: Pull the data you already have

You probably already track:

– Total revenue per customer

– Number of orders

– Signup dates and churn dates

– Product mix

– Acquisition source

Export data for the last 12 to 24 months.

From that, calculate:

– Average order value

– Repeat purchase rate

– Average number of orders per customer

– Monthly churn (for subscriptions)

– Average customer lifespan (so far)

– LTV by channel or by product

Do not wait until the data is perfect. Start with rough numbers, then refine.

Step 3: Put LTV and CAC side by side

On one simple dashboard, add:

– LTV by channel

– CAC by channel

– LTV:CAC ratio by channel

Look at where:

– LTV is high and CAC is reasonable

These are channels to feed.

– LTV is low and CAC is high

These either need a fix or need to be cut.

– LTV is high but CAC is also high

You might need better targeting or creatives. Or a different offer.

This helps you move from “Where did we get the cheapest leads?” to “Where do our best long term customers come from?”

Step 4: Set one or two LTV levers as quarterly priorities

Pick a single focus per quarter, such as:

– Raise 12-month LTV by 20 percent for customers acquired via paid social.

– Raise average orders per customer from 1.4 to 1.8 in 12 months.

– Increase average lifespan of subscribers from 8 to 11 months.

Then align projects to that focus:

– New onboarding sequence

– Revised packaging and pricing

– New retention campaigns

– Better product education

This is where strategy connects to daily work.

Step 5: Share LTV stories with your team

Numbers alone do not change behavior.

Share concrete customer stories that show:

– Long relationships that worked well

– Churn stories where someone left early and why

– Cases where a small change in experience led to deeper loyalty

As people connect the stories to the numbers, they start thinking in LTV terms:

– “Will this change keep customers longer?”

– “Will that message feel too pushy and hurt trust?”

– “What else does this buyer need from us next quarter?”

At that point, LTV is not just a metric. It becomes part of how your team thinks.

What life looks like when you really own LTV

When you build a business that takes LTV seriously, things feel different.

You do not panic every time acquisition costs go up a bit. You adjust.

You do not obsess only over this week’s sales. You pay attention to who is buying, how they buy, and how often they come back.

You stop envying low-price competitors who “sell more volume,” because you know high-LTV customers who actually get results from you are better for everyone involved.

Customers get more value over time.

Your team works with people who stay long enough to appreciate the work.

You get a business that feels less like a treadmill and more like a compounding asset.

If you treat every customer like a one-time transaction, business will always feel like starting over. When you build for lifetime value, every good day makes the next one easier.

LTV really is the only metric that ties together growth, resilience, and sanity. Once you see that, it is hard to go back to judging your business by this week’s revenue chart alone.